Who pays taxes through Orange

Any of who works in Korea but get salary, stock option, RSU(Restricted Stock Unit), ESPP(Employee Stock Purchase Plan), etc. from companies outside of Korea may join Orange. An individual even expatriates, who has his/her domicile in Korea or a place of residence for 183 days or more for two fiscal years in Korea, is subject to income tax on all incomes derived from sources both within and outside Korea.

[Income tax law Article 1 of 1, Tax Treaty Article 15]

Benefits from Orange

You get 10 percent tax deduction or credit if you pay taxes through Orange. We may call it Taxpayers Association Credit. Also, a foreign professional may avoid double-taxation by paying taxes in Korea first and by submitting a certificate of tax clearance to the tax office of your own country. Furthermore, when he/she needs to renew working visa and alien registration card to keep working, the immigration offices will ask a tax certificate showing he/she pays taxes in a proper manner. Orange provides with it whenever needed.

Taxable income

An employee’s wage and salary income refers to all types of payments received for personal services rendered as an employee in Korea. Any person who pays any of the following to a resident or non-resident in Korea shall collect the income tax at source from such resident or non-resident.

- Wage, salary, remuneration, allowance, bonus, and any other allowance of a similar nature received in return for services

- RSU(Restricted Stock Unit)

- ESPP(Employee Sotck Purchase Plan)

Rate of income tax

Expatriates can opt one from Progressive and Flat rate tax. However, Korean nationals should pay with progressive rate only.

Progressive rate (6 to 38 percent) A progressive rate tax is a tax in which the tax rate increases as the taxable amount increases.Progressive rate taxes are imposed in an attempt to reduce the tax incidence of people with a lower ability to pay, as such taxes shift the incidence increasingly to those with a higher ability-to-pay. All local Koreans should pay taxes with this progressive rate. The opposite of a progressive tax is a flat rate tax. Expatriates or foreigners can choose one between progressive and flat.

Flat rate (19 percent from 1 January 2017) A flat rate tax is a system of taxation where one tax rate is applied to all personal income with no deductions. Currenty(as of year 2016), the flat rate is 17 percent of income, and this flat rate tax is applicable to expatriates or foreigners only. The flat rate is increased to 19 percent for income earned after 1 January 2017 till 31 December 2018.

How to pay taxes

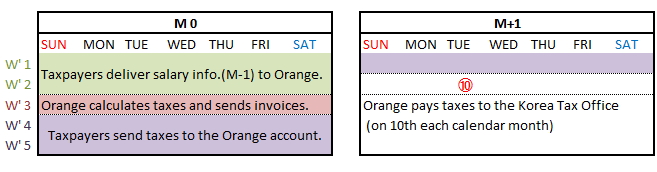

Upon Orange gets salary information for the previous month(M-1) from a taxpayer, Orange calculates and sends a tax invoice to the taxpayer. After the fund, or taxes hit Orange's bank account Orange arranges tax payments. Then, Orange pays all the taxes collected to the Korea Tax Office on 10 of the following calendar month(M+1).

Documents needed to proceed taxation

Please send Orange the following documents to proceed tax payments.

- Salary statement(or pay slips)

- A copy of Alien Registeration Card or identification card(Family’s ARC if they reside in Korea)

Should you need further information, please do not hesitate to contact Orange.